National Stock Exchange of India Limited

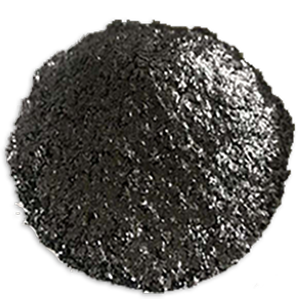

25th Floor, P J Towers Electric Arc Furnace

Plot No.C/1, G Block, Bandra - Kurla Complex

Sub: Transcript of Earnings Conference Call on Q3FY23 of HEG Limited

Please refer to our Earnings Conference Call scheduled on 20th February, 2023 intimated vide our letter dated 16th February, 2023. Please find enclosed the transcript of the said Earnings Conference Call.

The said transcript is also available under the Investors Section of the website of the Company i.e www.hegltd.com .

This is for your kind information and records.

Company Secretary M.No. A-13263 heg.investor@lnjbhilwara.com

Q3 FY '23 Conference Call"

M ANAGEMENT: M R. R AVI J HUNJHUNWALA - C HAIRMAN, M ANAGING

D IRECTOR AND C HIEF E XECUTIVE O FFICER - HEG

M R. R IJU J HUNJHUNWALA - V ICE C HAIRMAN - HEG

M R. M ANISH G ULATI - E XECUTIVE D IRECTOR - HEG

M R. O M P RAKASH A JMERA - G ROUP C HIEF

F INANCIAL O FFICER - HEG L IMITED

M R. G ULSHAN K UMAR S AKHUJA - C HIEF F INANCIAL

O FFICER - HEG L IMITED

MODERATOR: M R. N AVIN A GRAWAL - H EAD, I NSTITUTIONAL E QUITIES - SKP S SECURITIES L IMITED

Good day, ladies and gentlemen. Welcome to the HEG Limited Q3 FY '23 Earnings Conference

Call organized by SKP Securities Limited. As a reminder, all participant lines will be in the

listen-only mode and there will be an opportunity for you to ask questions after the

management's opening remarks. Should you need assistance during the conference call, please

signal an operator by pressing star then zero on your touchtone phone. Please note that this

I now hand the conference over to Mr. Navin Agrawal, Head, Institutional Equities at SKP

Securities Limited. Thank you, and over to you, sir.

Good afternoon, ladies and gentlemen. It's my pleasure to welcome you on behalf of HEG

Limited and SKP Securities to this financial results conference call with the leadership team at

HEG Limited. We have with us Mr. Ravi Jhunjhunwala, Chairman, Managing Director and

CEO, and Mr. Riju Jhunjhunwala, Vice Chairman, along with their colleagues, Mr. Manish

Gulati, Executive Director, Mr. Om Prakash Ajmera, Group CFO, and Mr. Gulshan Kumar

We'll have the opening remarks from Mr. Jhunjhunwala, followed by a Q&A session. Thank

you, and over to you, Ravi ji.

Thank you, Navin. Friends, good afternoon, and welcome to our Q3 financial results call for the

current year. Geopolitical situation continues to be worrisome with no immediate end in sight

resulting in dragging down most of the rich economies around the world. Countries like EU,

Japan seem to be the hardest hit with soaring electricity and energy prices, leading to high

inflation, high interest rates, etcetera.

Steel production being directly related to the GDP of any country saw a decline of 4.4% in

calendar year '22 versus 2021. If we exclude China, this fall was even more steep at about 7%.

Meanwhile, the developed as well as the developing world continues its efforts to decarbonize

and reduce greenhouse emissions and have pledged large sums of money to be carbon neutral in

As most of you are aware, steel produced through electric arc furnace emits 3 times less carbon

than similar steel produced by blast furnaces. This is giving a fillip to many new electric arc

furnace plants being announced in several parts of the world. More than 20 million tons of

greenfield electric arc furnace have been announced by the US alone. Out of which 7 million

tons have already started production in the last 12 months, while another about 14 million tons

would be in operation in the next 12 to 24 months, adding to large electrode demand. Similarly,

many large steel producers like Arcelor Mittal and many others have also announced a

replacement of about 16 million to 18 million tons of electric arc furnace capacities in Europe.

As per World Steel Association, electric arc furnace, excluding China, has grown at a 4% CAGR

for the period 2015 to 2022 and now accounts for 49% of total steel production, up from 47%

about two years ago. China, although lagging behind in this effort and producing only 12%

through electric arc furnace, is also on the path to increase its EAF share of steelmaking to about

20% in the next three to five years as they also make efforts to control carbon emission. We believe electric arc furnace steel production growth in the region to be in the 4% CAGR, in the next decade, which could see an increase of about 200,000 tons of additional electrode demand.

In the short term, the outlook for the steel industry appears to be bearish. Steel demand is still being impacted by the fear of a global recession, but the medium- to long-term growth path for EAF is very clear. Our expansion is almost nearing completion with four different processes, already commissioned and starting to produce.

One shop, the last shop is running three months behind schedule due to delays in arrival of some imported parts and equipments from various overseas suppliers, which have already arrived, as we speak, at the plant, and we expect to complete the full expansion by mid-April and with a brief period of trials and stabilization, it will also come on stream. Our capacity would then be 100,000 tons, making it the most modern and the largest state-of-the-art plant anywhere in the world.

As our industry is very consolidated, with technology in the hands of just five companies and China, although having large electrode manufacturing capacity, but not a very major competitor to us in the UHP, Ultra-High Power space, we believe that our expansion of 20,000 tons is fairly well timed and will be quickly absorbed by the market.

Friends, now coming to the quarter 3, we operated at 60% of our capacity, which was the lowest in this year. And in the current quarter, January, March, we have inched up to about 70%. We've been able to maintain our product pricing in the past three quarters. This quarter's performance was reasonably good compared to past two quarters despite lower sales of graphite electrodes due to benefit of rupee depreciation and better profits from our hydropower generation facilities in Madhya Pradesh. As is very normal in any business, when capacity utilizations are low, the price does come under pressure, which is what we are seeing as we book orders for Q1 of next year.

Needle coke procurement prices for the past three quarters have been flattish, and we now see some softening in the prices of the needle coke. As we are booking electrode orders for the next three to six months, needle coke procurement is also being done on a quarterly basis. So the movement of needle coke prices cannot be forecasted accurately, although our expectation is that they may soften a bit due to lower demand from electrode industry and abundant availability of coke due to slowing down of off take by all the major graphite producers.

All-in-all, we remain highly positive and confident about the medium- to long-term growth for electrode industry and more so for HEG. We, being one of the most competitive producers in terms of quality and cost and a wide outreach to global markets, which we have developed over the last 25 years and continuously exporting about 2/3 of our production to more than 35 countries.

Meanwhile, as you are aware, we are diversifying into graphite anode for lithium-ion cells, which form the battery for electrical vehicles and energy storage systems. Given that it's the first such plant coming in our country, we see a huge opportunity here in the long term. We have

incorporated a wholly owned subsidiary of HEG in the name of TACC Limited for this new business, and our Board has approved a budget of INR 1,000 crores for setting up manufacturing facility of 10,000 tons of anodes per annum in Phase 1, which should be in operation by Q2 of calendar year 2025. At present, cells and battery packs are all imported into India, and soon there will be a huge domestic demand for graphite anode as cell manufacturing shifts to India. We see tremendous potential for this business in the next three to five years as more-and-more EVs get

With this friends, I will now hand over the floor to our CFO, Gulshan, to take you through the

financial numbers. And then along with Manish, our ED, we'll be very happy to answer any

queries that you have on electrodes and Riju Jhunjhunwala, also being present on the call, can

answer all the queries pertaining to anode powder. Thank you. Over to Gulshan.

Thank you, sir. Good afternoon, friends. I will now briefly take you through company's operating

and financial performance for the quarter ended 31st December 2022. For the quarter and nine

months ended 31, December 2022, HEG recorded revenue from operations of INR 530 crores

as against INR 598 crores in the previous quarter and INR 597 crores in the corresponding

quarter of the previous year. Revenue for the quarter saw a decrease of 11% as compared to the

previous quarter and on Q-on-Q basis as well.

During the quarter ended 31, December 2022, the company delivered EBITDA including other

income of INR 170 crores as against INR 198 crores in the previous quarter and INR 171 crores

in the corresponding quarter of the previous financial year. The company, on a standalone basis

recorded a net profit after tax of INR 103 crores in the third quarter of FY 2023 as against INR

130 crores in the previous quarter and INR 109 crores in the corresponding quarter of the

previous financial year. The company is long-term debt free and have treasury size of nearly

INR 1,015 crores as on 31, December 2022.

To take up more questions from the participants, the detailed presentation has been uploaded on

the company's website and on the stock exchange. We would now like to address any questions

or queries you have in your mind. Thank you. Over to Navin.

We have our first question from the line of Sonali Salgaonkar from Jefferies.

I missed the number of capacity utilization for your in the December quarter?

I said October, December quarter was about 60%. And in January, March, we had in stock to

Sir, what was the number a year back in the same quarter, that's Q3 FY '22?

In quarter 3, 2021, '22, that capacity utilization was the range around 85%.

Sir, you did address in your opening remarks the reason for lower demand citing that's on the

expectation of a global recession. But could you elaborate more as to which countries

particularly you are looking at this different steel production, considering that you are exporting

Graphite Electrode for Arc Furnaces HEG Ltd. published this content on 24 February 2023 and is solely responsible for the information contained therein. Distributed by Public, unedited and unaltered, on 24 February 2023 16:36:21 UTC.